Here’s A Quick Way To Solve A Info About How To Write Loan Agreement

![40+ Simple Loan Agreement Templates [FREE] ᐅ TemplateLab](https://signaturely.com/wp-content/uploads/2020/06/loan_agreement_template1.jpg)

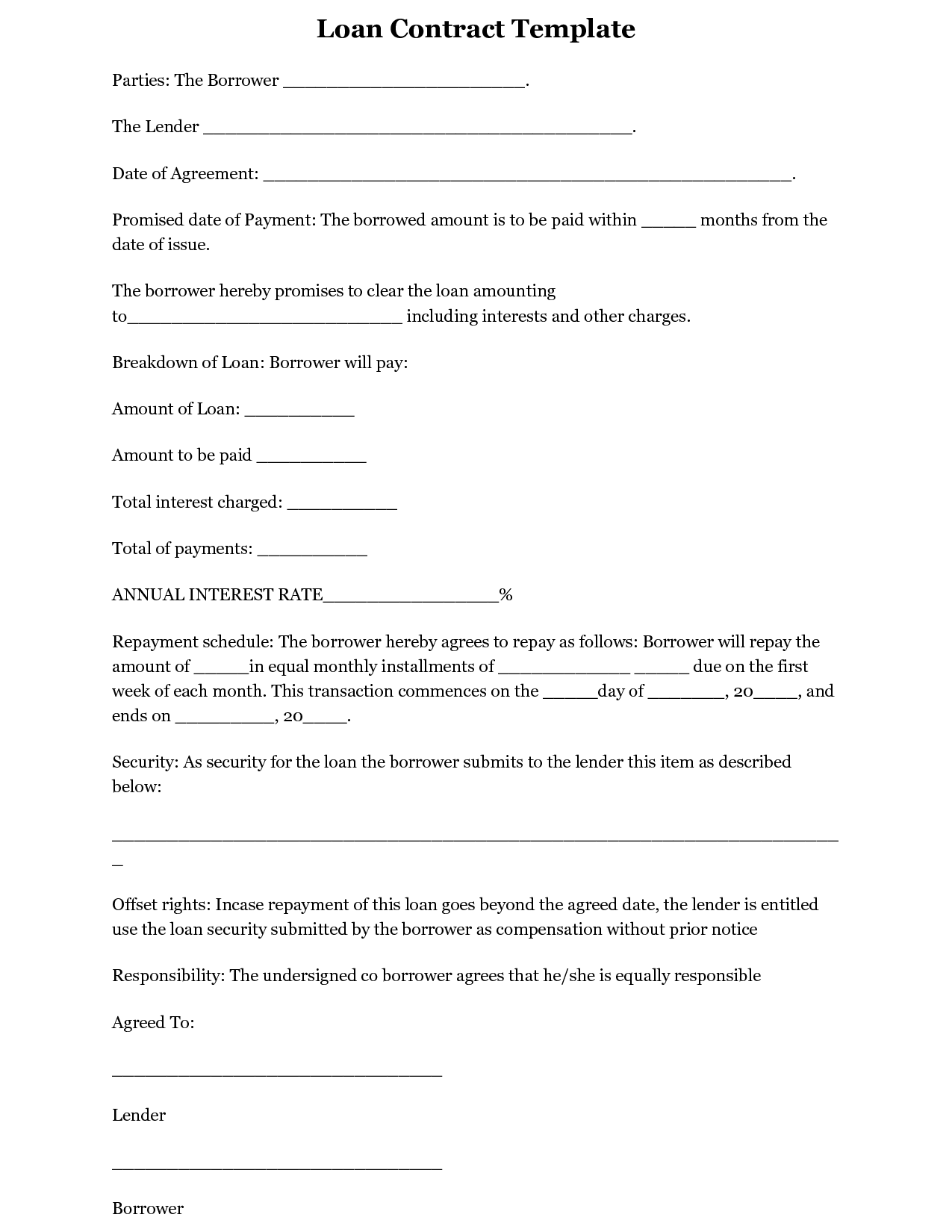

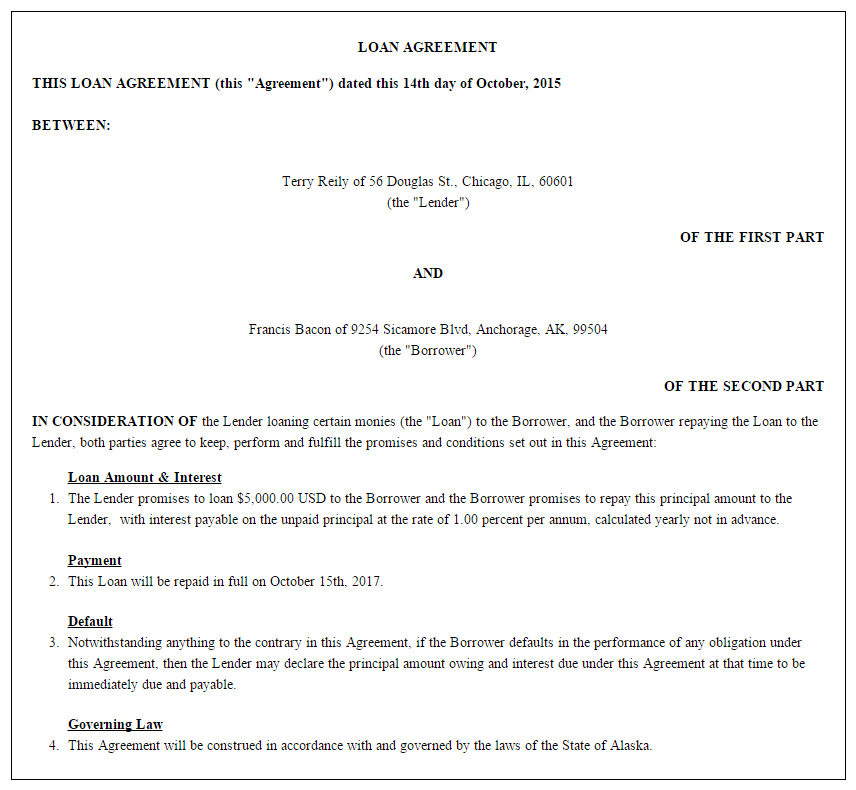

Formats word and pdf.

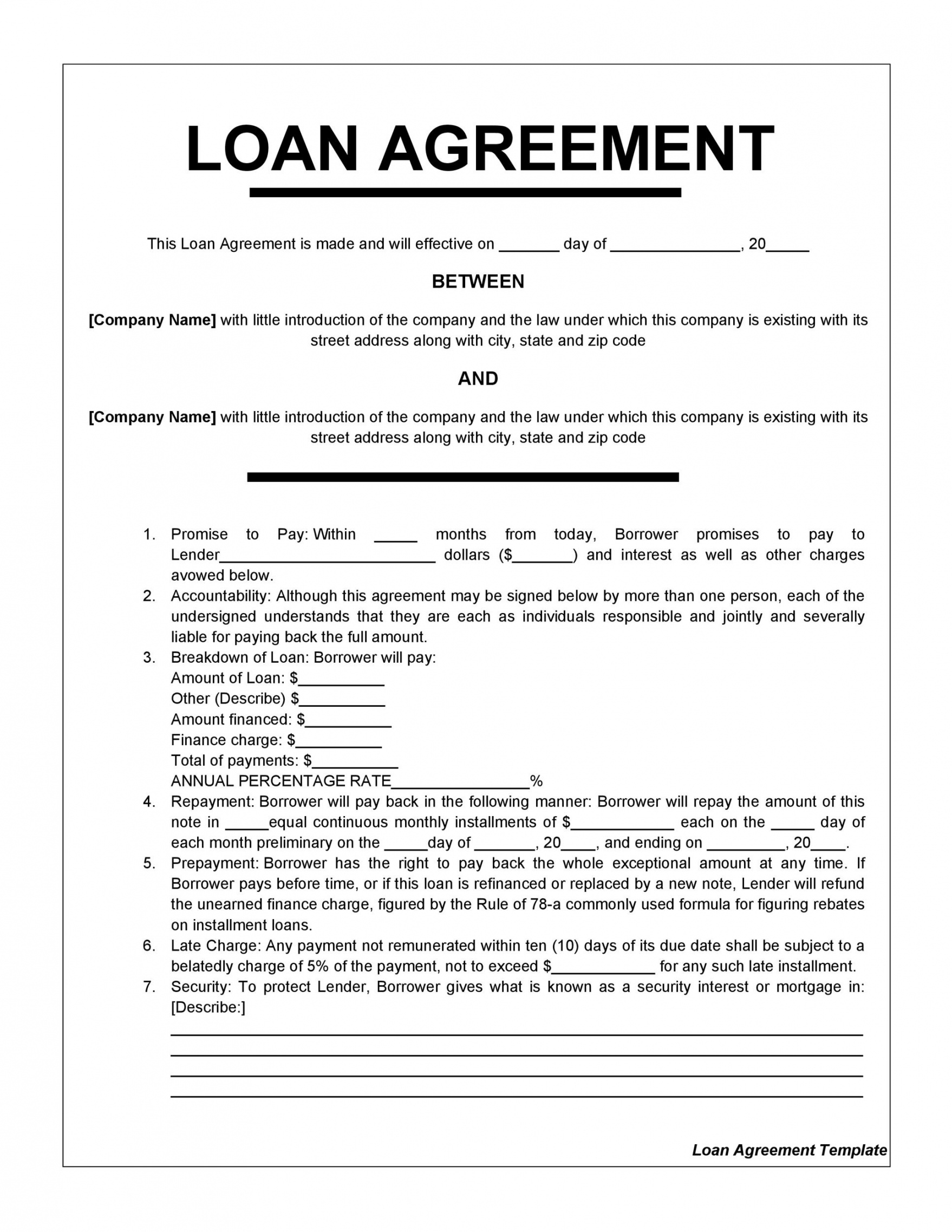

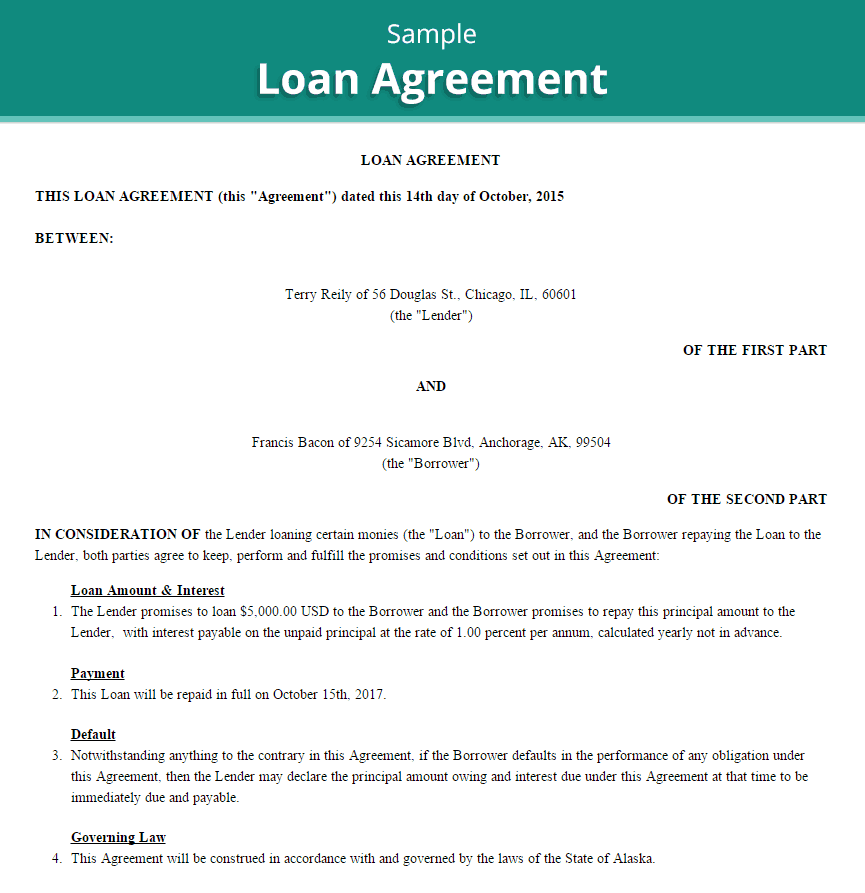

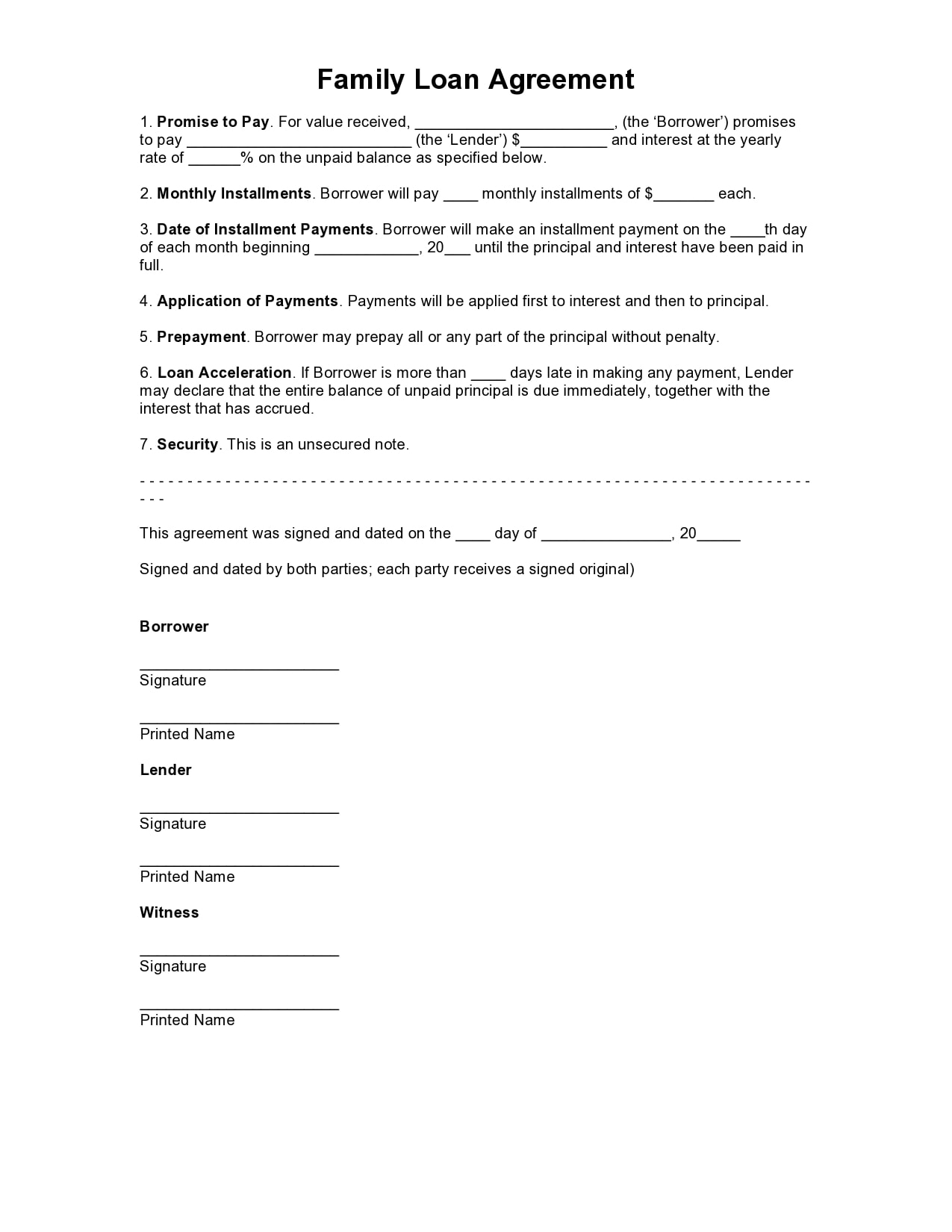

How to write loan agreement. It sets out a repayment plan, with interest and other. Size 5 to 7 pages. A loan agreement or loan contract is a written agreement that specifies all the details of a personal or business loan, including the amount of money or the assets being lent, the repayment terms, and what happens if the borrower defaults (is unable to pay according.

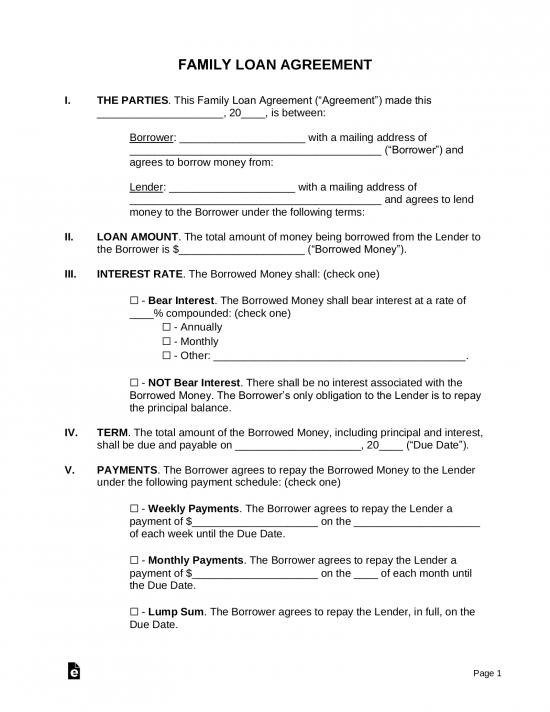

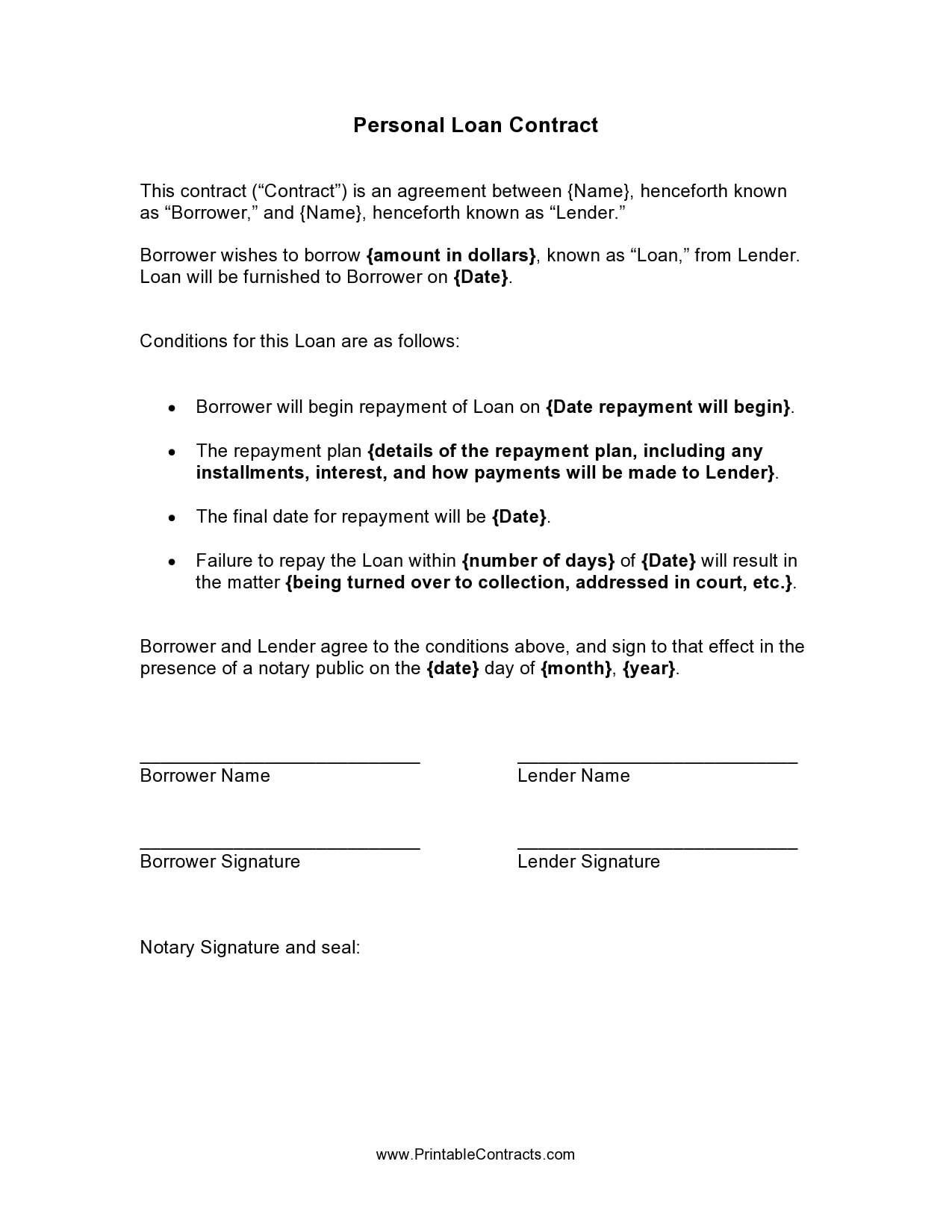

You should use a written loan agreement whenever you lend or borrow money. It can be drafted with an official lender or used in a more informal situation, such as with a friend or family member. Updated on november 16, 2022.

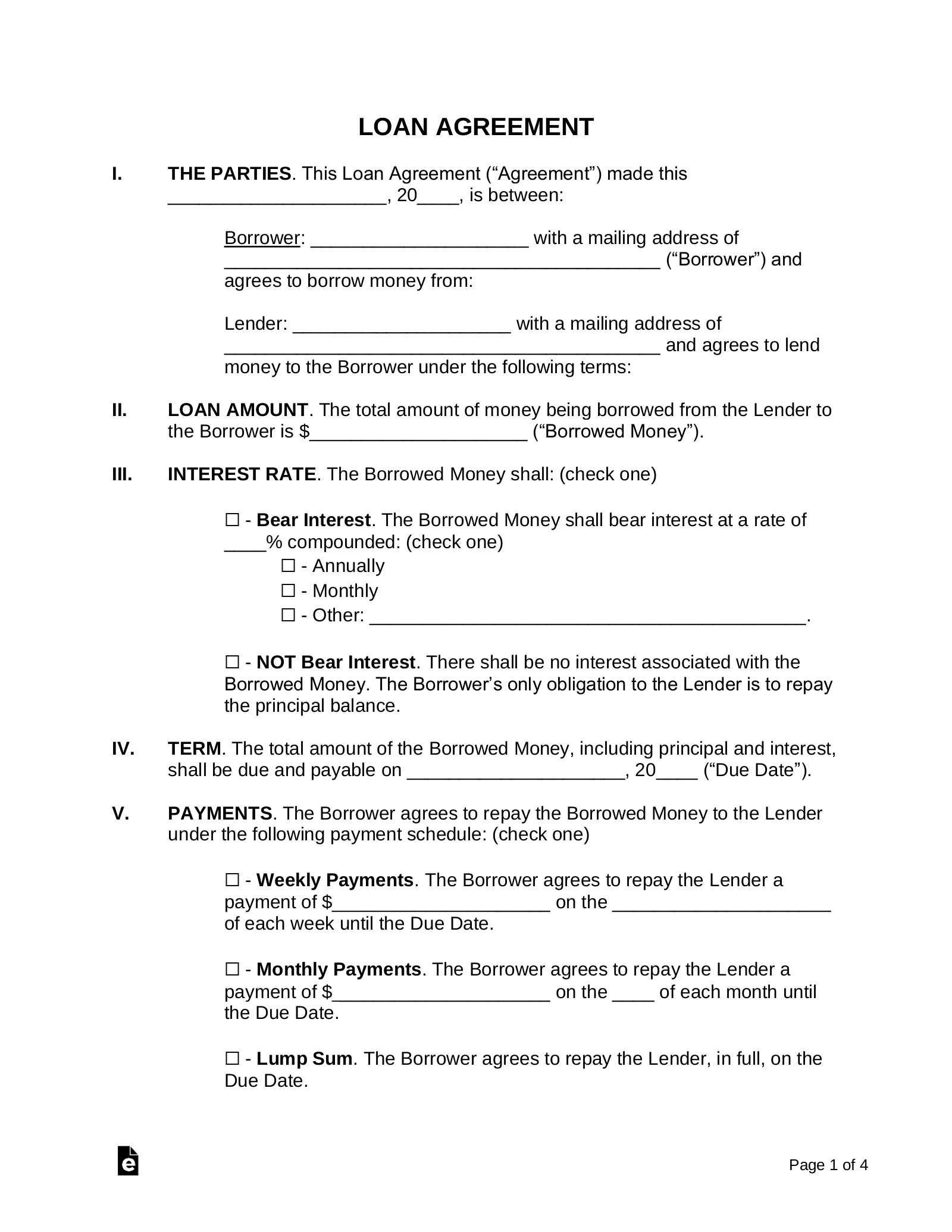

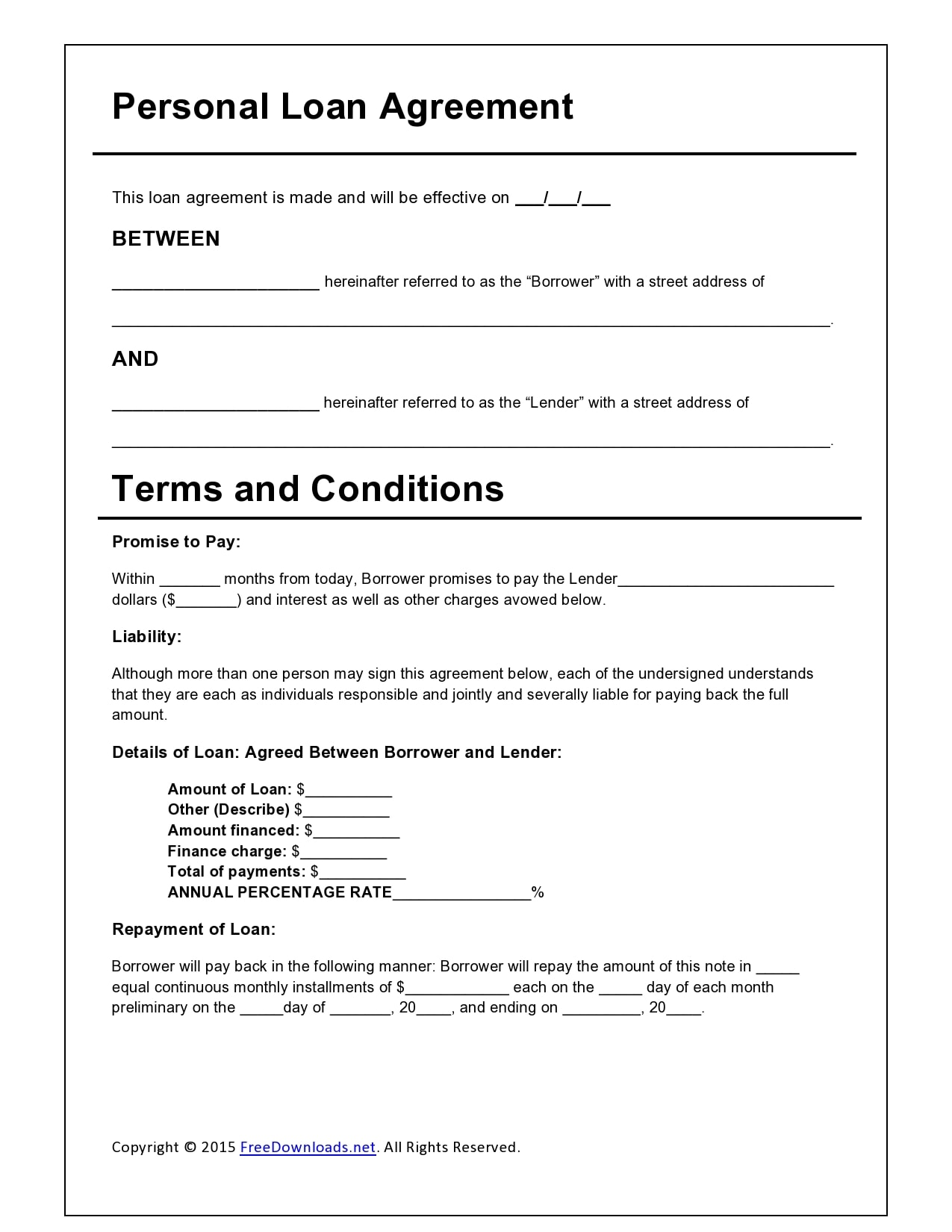

Clearly identify the borrower and the lender by including their full name, address, and contact information. Drafting a loan agreement may seem like a daunting task, but it’s a crucial step to legally protecting. A promissory note is where one party promises, in writing, to pay a set amount to the other according to their agreement.

A loan agreement is a written promise from a lender to loan money to someone in exchange for the borrower's promise to repay the money lent as described by the. The contract defines who the borrower and lender are, the amount of money lent, the interest rate, and how long the borrower has to pay it back. A loan agreement establishes the loan terms, including the amount borrowed, the interest rate, and the repayment schedule.

A loan agreement is a written contract between a lender (the party providing money) and a. A personal loan agreement is a legally binding document to outline the repayment terms of a loan, such as the interest rate, fees, collateral, and penalties. Get help with a loan contract.

This guide will help you to write an authoritative and effective loan agreement that can be used for a variety of different. Don’t want to get caught up in loan disputes and misunderstandings? Here are some situations where you may need to create this document:

How can a lawyer help? How to write a loan agreement? Purchasing land or a home with.

A loan agreement is a contract between a borrower and a lender that specifies what each party has agreed to. A loan agreement is formal proof that the two parties have an agreement for how borrowed money will be paid back. What’s typically included in loan contracts?

It is a formal document that evidences a loan. Understand the purpose of a loan agreement. When drafting a loan agreement, there are several key provisions that you should include to.

Writing a loan agreement template can be tough if you are not sure what needs to be included in this important document. It protects both parties in case they later have. Learn how to draft a loan agreement with rocket lawyer's easy online interview, including the following.

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-20.jpg)

![40+ Simple Loan Agreement Templates [FREE] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-04-790x1118.jpg)

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-27.jpg?w=320)

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-36.jpg?w=790)

![40+ Free Loan Agreement Templates [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-08.jpg)

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-32.jpg)