Great Tips About How To Buy Ge Corporate Bonds

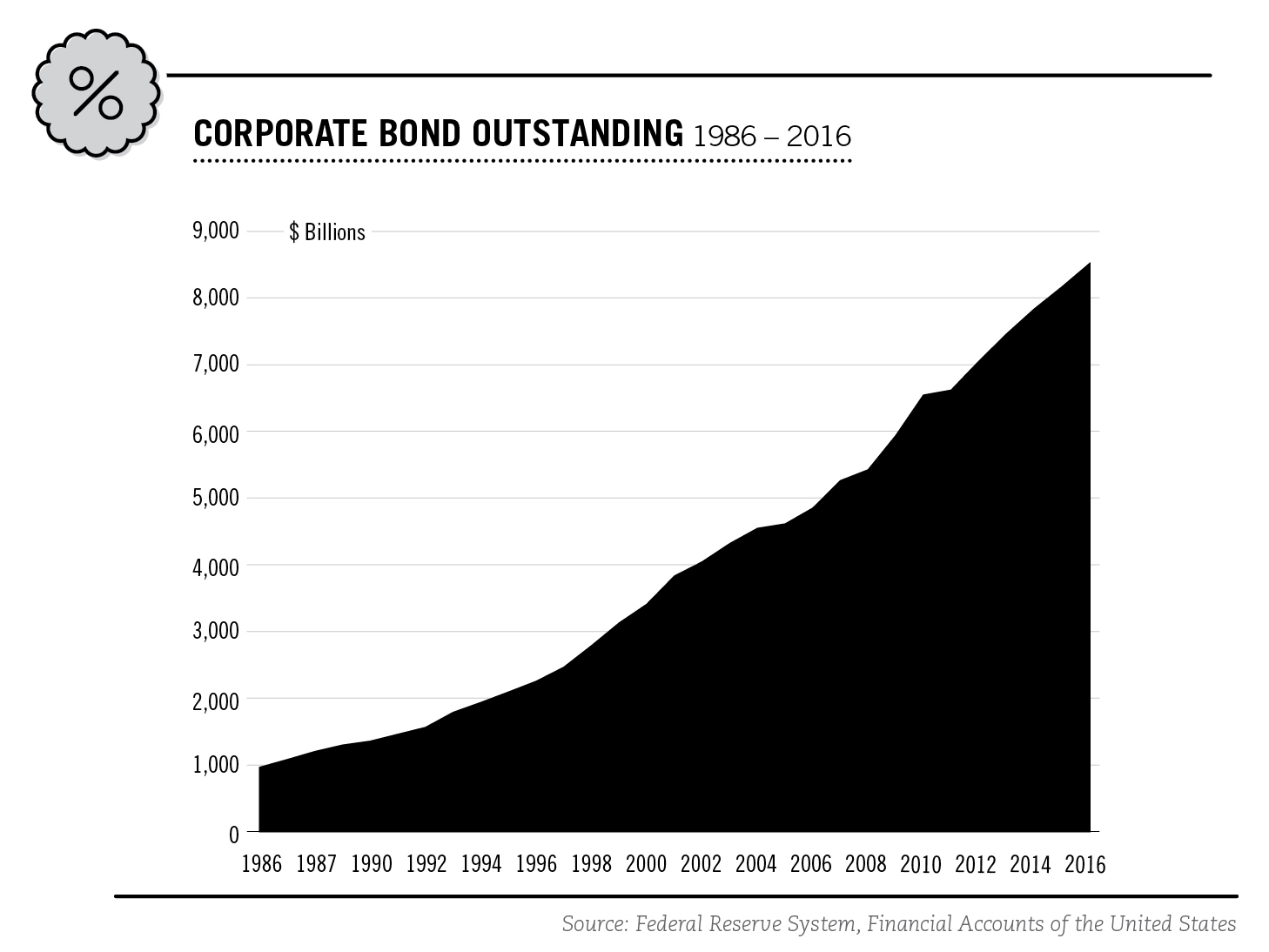

Is offering to buy back as much as $23 billion of bonds in one of the largest corporate debt buybacks ever as the industrial giant carries out a.

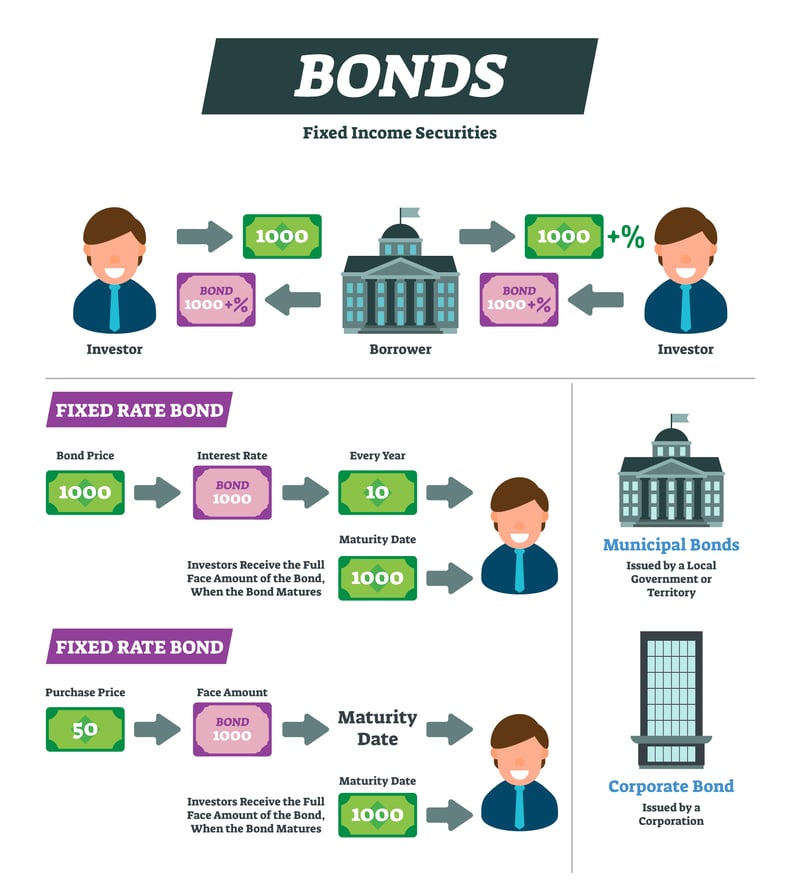

How to buy ge corporate bonds. Investors can purchase a corporate bond on either the primary or secondary markets, and they offer predictable payouts and strong liquidity. Bondsavvy presents between 20 to 25 corporate bond investment opportunities each year where we review each issuing company in detail, including its financial performance,. A corporate bond is a debt obligation issued by a business to raise money.

The first step to investing in stocks, including general electric, is to open a brokerage account. How can i invest in them? The ge split:

Issue information international bonds general electric, 6.75% 15mar2032, usd (a). General electric is offering to buy back as much as $23 billion of bonds in one of the largest. Corporate bond buyers are lending money to the company, while the company has a.

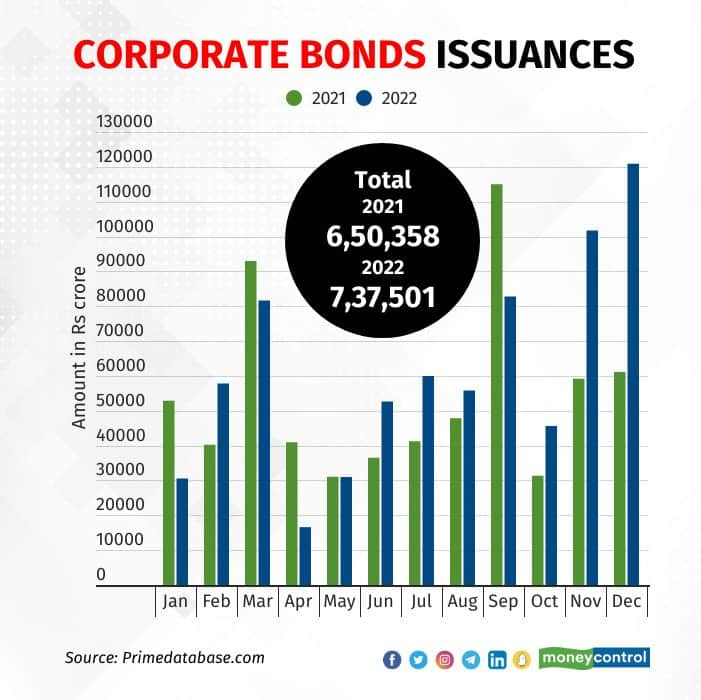

Investors have been eager to invest in corporate bonds in georgia, he says, but this has largely concerned eurobonds, which are a concern for local companies. Although a wide range of corporate bonds. Ge common stock is listed on the:

How to buy corporate bonds. By caleb mutua bloomberg,updated november 10, 2021, 5:20 p.m. Corporate bonds vary in their maturity,.

General electric co. Home coin understanding mutual funds and coin about mutual funds what are corporate bonds? Corporate bonds are debt securities issued by a.

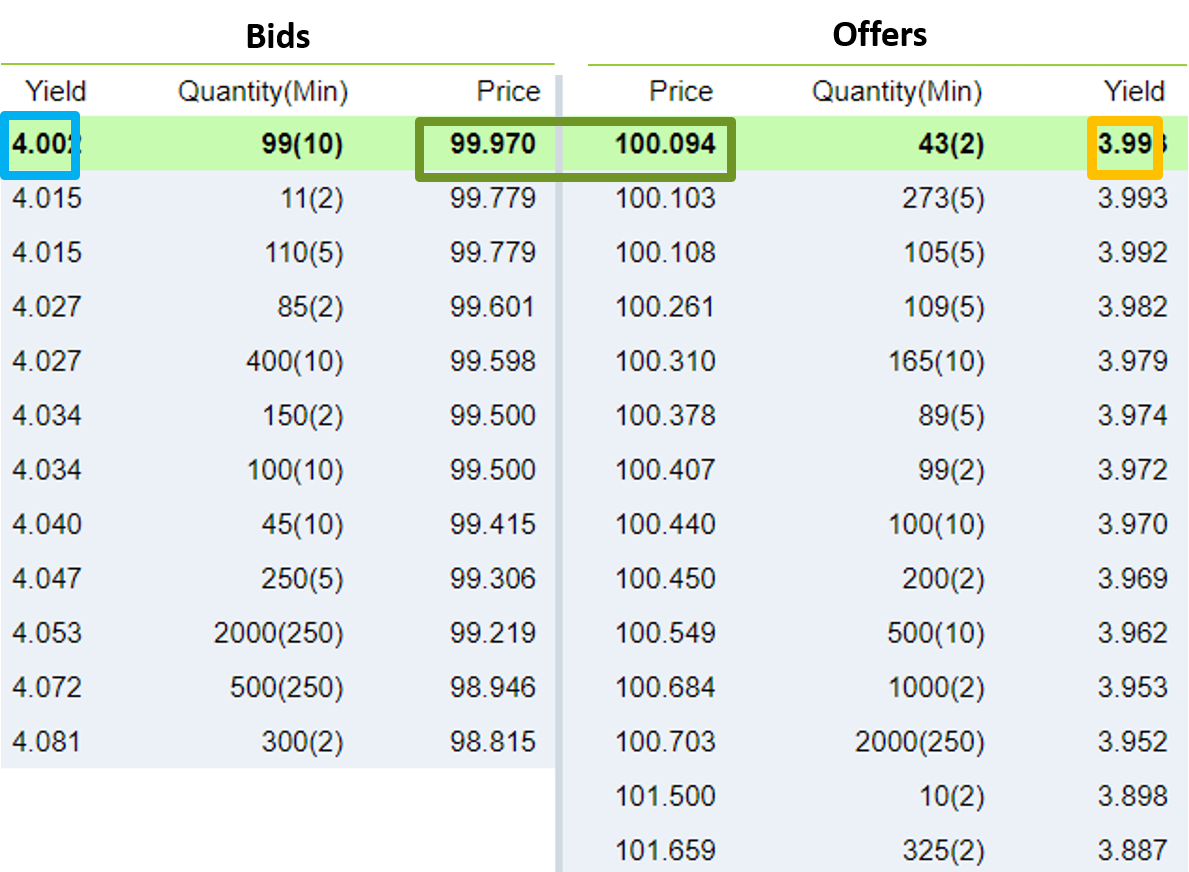

Ge’s corporate bonds mostly rallied last week, with its most active 4.4% bbb+ coupon bonds due in november 2035 rallying on a spread basis by about 2.6%,. A look at each new company’s profile, leadership. Said it now expects to buy back $25 billion of bonds, expanding one of the biggest debt.

Go to your preferred stock price information website, such as yahoo finance or google finance. 2:01 this article is for subscribers only. Issue, issuer, yield, prices, payments, analytical comments, ratings.

Corporate bonds tend to be a less risky investment than stocks, but involve more risk than treasury or municipal bonds. To invest in the corporate bond market, you could either buy actual bonds or shares in a bond etf. Log into your brokerage account and enter the company’s ticker symbol—ge—and the number of shares you want to buy or the dollar amount you want.