Outrageous Info About How To Become An Acquirer

Here’s what acquirers do, how they work, and how to choose one.

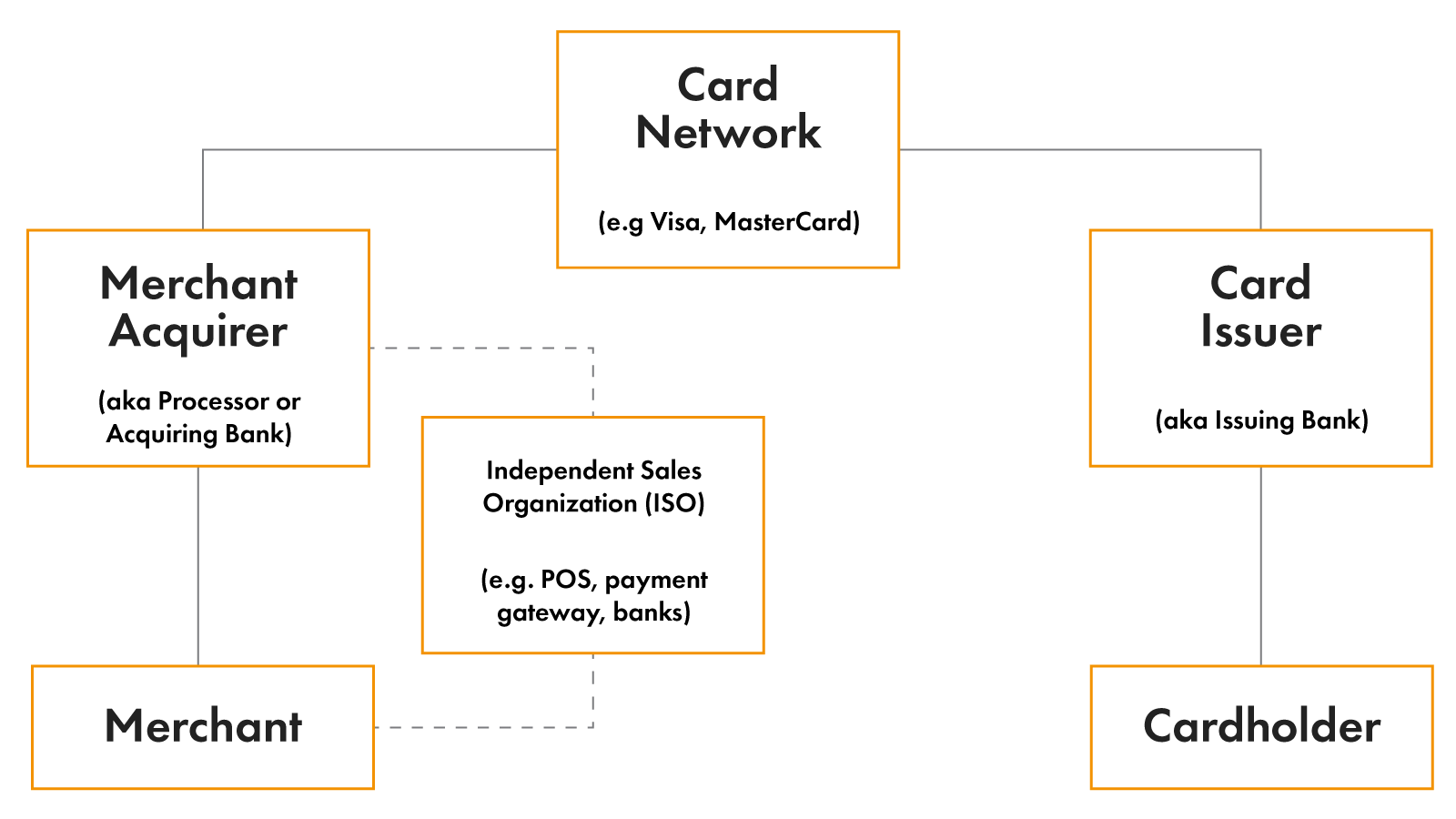

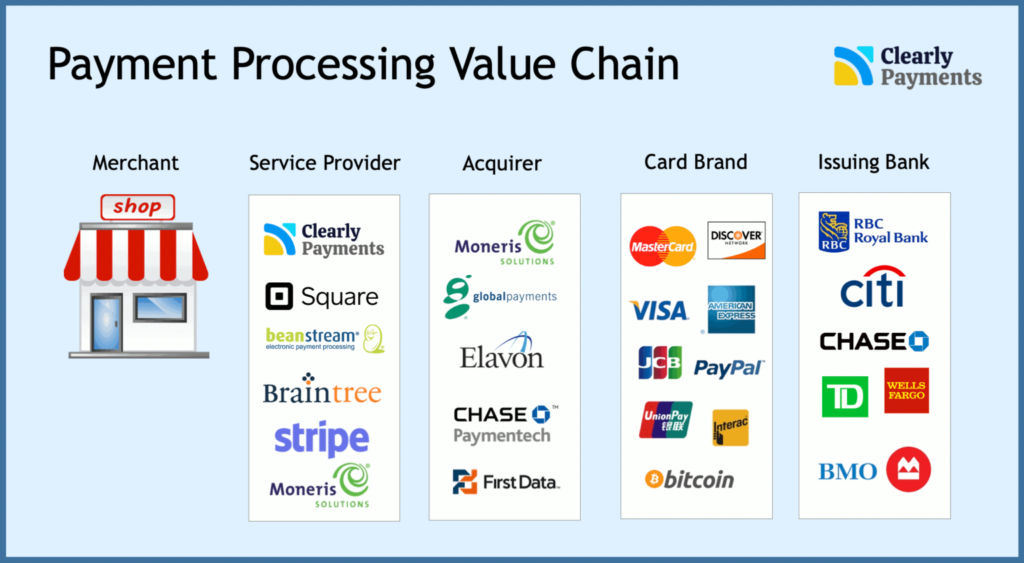

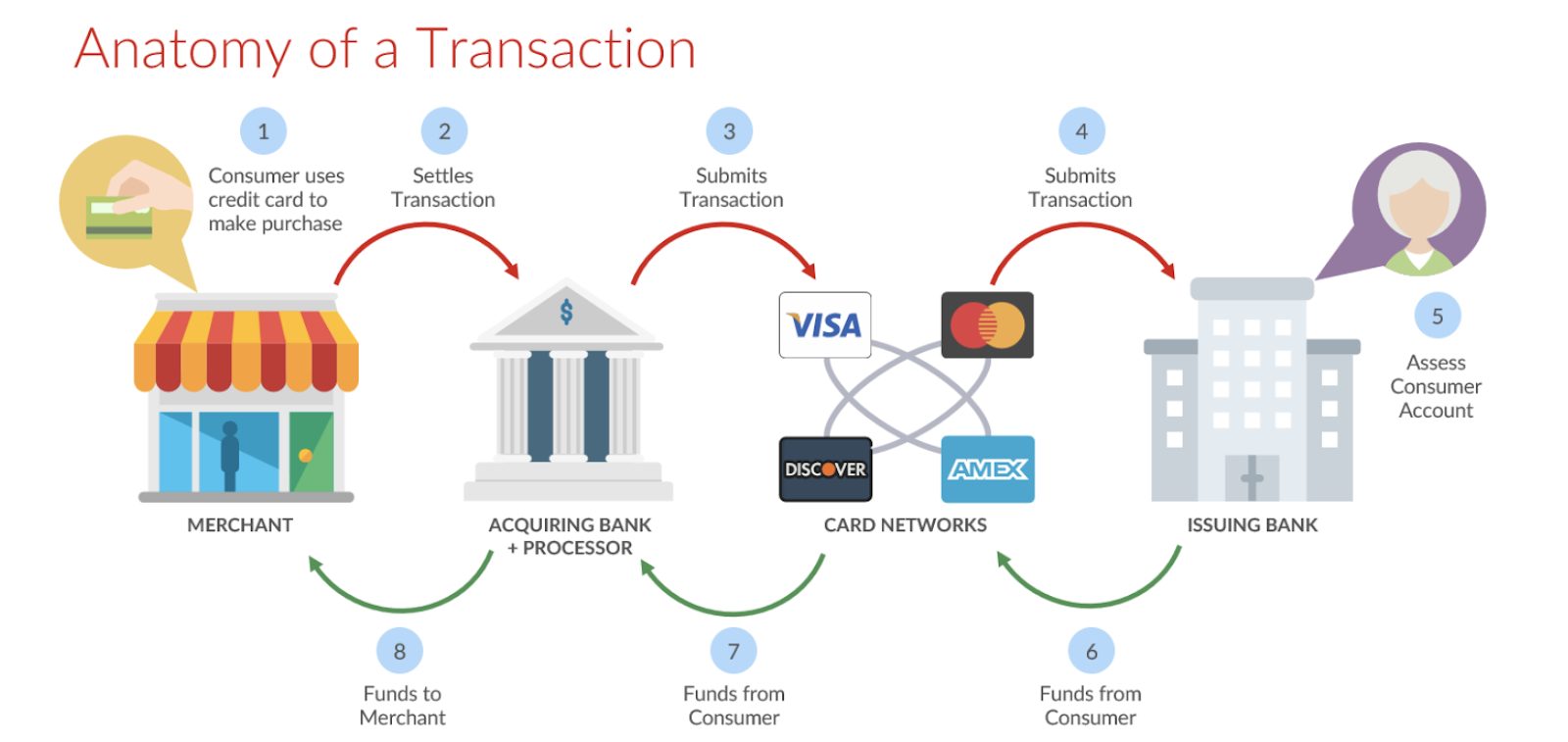

How to become an acquirer. To accept mastercard, a business must first contact an acquirer to begin the merchant account application. An acquirer may be a bank or a financial institution that is a licensed member of a card. As the last one indicates, a merchant acquirer is a financial institution like a bank that handles sales deposits and can process refunds.

Acquiring banks process payments for businesses. Also known as the acquiring bank or merchant bank, the acquirer is a financial institution that handles a merchant’s account so that they can. Capital one financial corp., the us lender backed by warren buffett, is set to buy discover financial services in a $35 billion deal that will bring together two of.

Shares of discover are down 1.7% lower for. If it’s not authorized, your acquirer tells you why. In these transactions, the issuer takes on the risk of issuing credit to an individual.

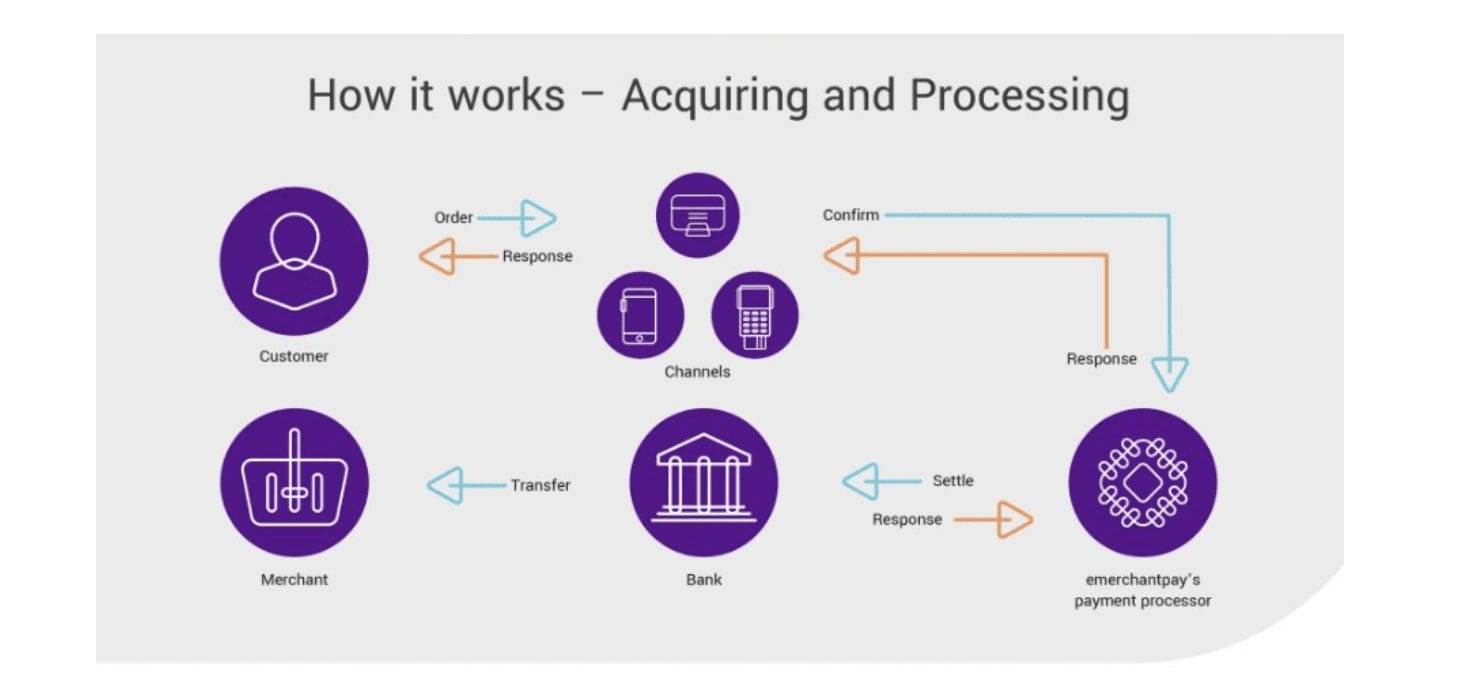

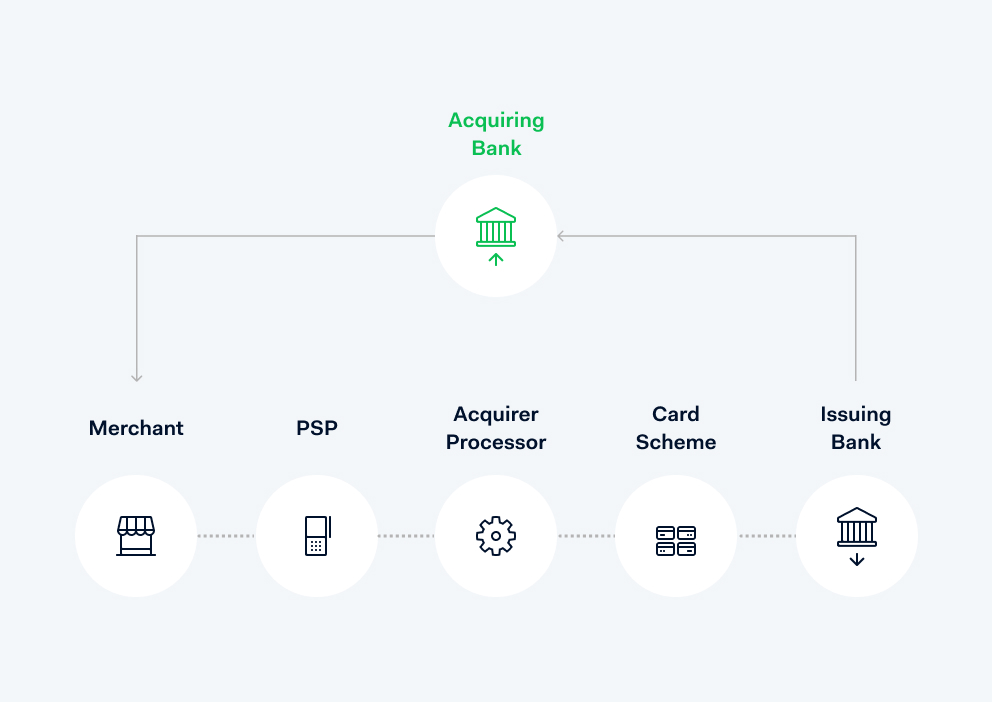

The first step is for the merchant to establish a merchant account with a bank acquirer. The primary purpose of an acquiring bank (also known as a merchant acquirer, or simply as an acquirer) is to facilitate payment card transactions. What is a merchant acquirer?

In order to accept online payments for your goods or services as a company, you have to sign up for a merchant account with an acquirer. While the issuer of a card handles the marketing and. In this issue of cfo insights, we will examine the common mistakes that happen in merger waves and outline ways that cfos can potentially avoid them by becoming advantaged.

A merchant acquirer (or acquiring bank) gives your business the ability to accept credit card or debit card transactions and handles the communication between your business. When the transaction is authorized, the acquirer retrieves the funds. In order to know how to become a.

Acquirers must be licensed by local. The answer is quite simple. The news comes on the back of a bloomberg news report on monday that capital one was considering an acquisition.

Capital one is buying discover in a deal worth more than $35 billion the companies are teaming up, in part, to expand their payment network. August 17, 2020 if you’re an entrepreneur, you’ve likely looked into accepting debit and credit cards for your business and have come across the word “acquirer”. This involves providing necessary business.

Merchant account setup: The csf can help an organization become a smart acquirer and supplier of technology products and. If you want to be a merchant acquirer, authoripay can help by getting you your own card scheme memberships.

The issuer and acquirer handle a given transaction. Merchant acquirers, also called acquiring banks, play an important role in payment processing. When your customer submits their payment card details, your acquirer initiates a request to authorise the.