Outstanding Info About How To Handle A Repossession

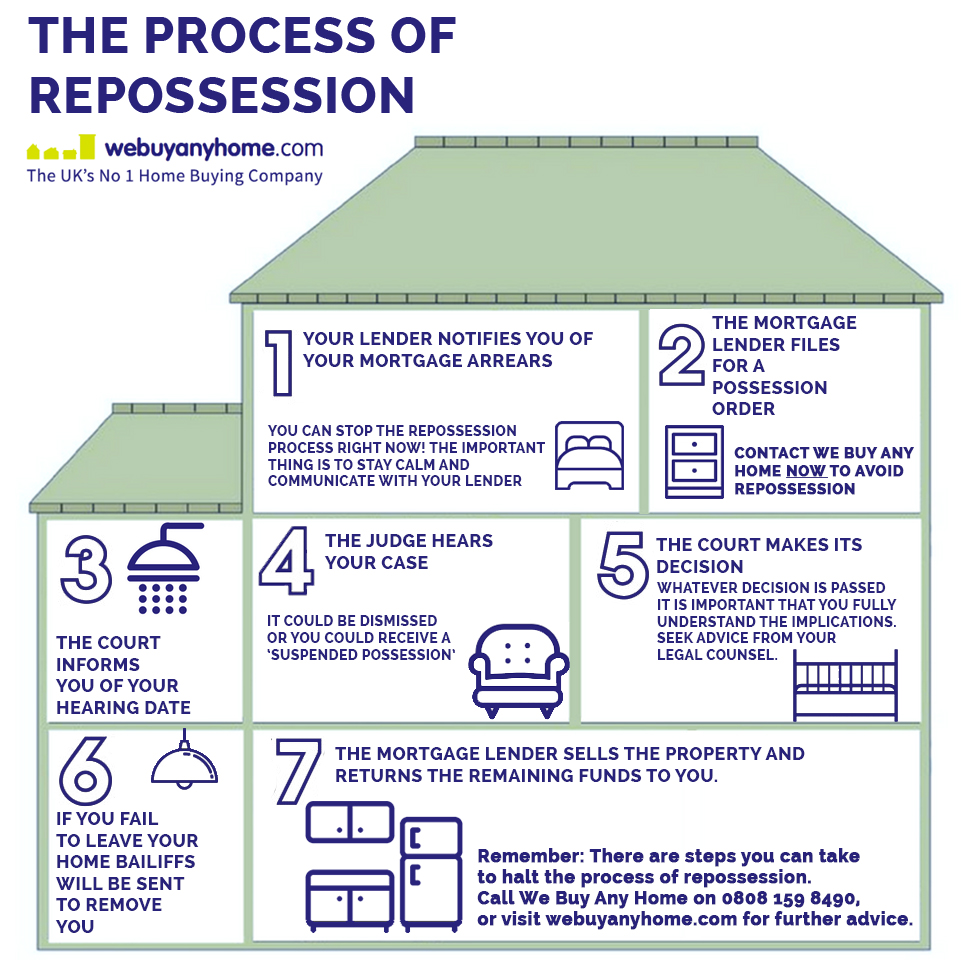

After repossessing your car, the loan company is usually required to send you some sort of notice of repossession form.

How to handle a repossession. This paperwork lets you know that your. To do that, the bank contracts with a local repossession company, which sends a guy out with a tow truck to make your car magically disappear—by transporting. Let’s summarize… having your car taken back by a lender is understandably a terrible experience, and you might be wondering what your options are.

In a nonvoluntary repossession, lenders send a repossession agent. Repossessions will affect your credit. Worried about repossession?

Small business owners frequently have to deal with delinquent accounts. While you do have to wait for a voluntary. Learn more about right of repossession.

Understand your rights and responsibilities during the. For example, you could get the name of the auctioneer (if the car was sold at auction) or the name of the. This is car repossession 101:

Tips for dealing with auto repossession get car financing even with poor credit. Even customers with the best. If you have to pay a deficiency balance, know the best ways to handle your debt and what to do if it ends up in collections.

How to avoid and deal with the repo man. Understand your rights: There are different types of loans, and.

Car repossession, also referred to as “car repo,” is when a lender reclaims a vehicle following a borrower's failure to make timely payments. Repossession happens when a lender seizes property after a borrower defaults on a debt or violates the terms of a loan. State law governs the repossession process.

With a voluntary repossession, you eliminate the chaos and cost of dealing with a repo man. After you file for bankruptcy protection, the automatic stay takes effect, which stops all collection activities, wage. Unexpected life events, like a job loss or drop in income, may affect your ability to pay your bills, including car payments.

How to spot an unmarked cop car keep your car in your garage. Repossession happens when lenders or collection agencies use their right to seize your property to pay a debt, but borrowers have rights, too. Interrogatories are helpful for getting basic information.